Wednesday, January 31, 2007

What The Problem Is, And How It Came To Be

In short, compulsive buying and credit card debt. I had taken 401k loans in the past to pay off debt and then ran the cards back up.In June, I was in a bind and took a 401k withdrawal.I expected to have to pay taxes and a 10%penalty. I did not expect to pay 35% taxes and a a 10% penalty. 25% was withheld automatically, now I am on the hook for 10% additional tax and the penalty;around 10k. My job no longer allows me to get overtime or a mileage reimbursement. This was about 10,00 in income loss . I was making a salary in the mid 40's with both of these things and their loss has been nothing short of catastrophic. My addictive buying after the withdrawal did not help, I still have credit card debt.I would actually prefer to ba an alcoholic, at least you just die from that.My wife is one of those unlucky to be one of those people who just qualify for the AMT, put it all together and it spells almost 15k owed to the IRS. Wheeee!

Labels:

401k,

AMT.Compulsive buying,

credit card,

debt,

income tax

Tuesday, January 30, 2007

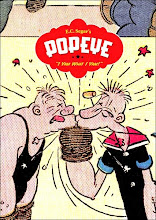

The Great Sale Has Begun!

Because of a tremendous amount of debt and loss of income(which I will detail later), the arrival of a huge tax bill(Thanks ,AMT) has forced me into that most dread of days for collectors...The Great Sale. I will post about the progress of the sale and the removal of the debt as the days go by. Feel free to check out my auctions on eBay. I think I will also install a virtual tip jar just to make the debasement complete. More soon.

Subscribe to:

Posts (Atom)